Selling an HVAC business can be complicated. One of the best ways to find a buyer is to diligently prepare. One of the best ways to prepare is to anticipate what questions a potential buyer will ask and be ready to answer them. Based on our experience helping clients with their exit plans and mergers and acquisition-type transactions, we’ve come up with 11 questions you should be ready to answer when selling your HVAC business:

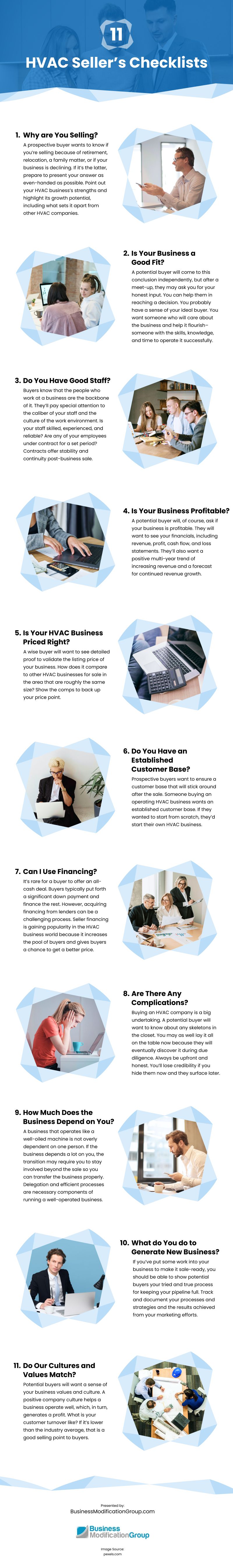

1. Why are You Selling?

A prospective buyer wants to know if you’re selling because of retirement, relocation, a family matter, or if your business is declining. If it’s the latter, prepare to present your answer as even-handed as possible. Point out your HVAC business’s strengths and highlight its growth potential, including what sets it apart from other HVAC companies.

A buyer will appreciate honesty, and when you lay your cards on the table, a buyer may see its potential as a worthwhile investment. If you’re selling for financial reasons, consider suggesting how the right buyer can turn it around. After all, you know the business better than anyone.

2. Is Your Business a Good Fit?

A potential buyer will come to this conclusion independently, but after a meet-up, they may ask you for your honest input. You can help them in reaching a decision. You probably have a sense of your ideal buyer. You want someone who will care about the business and help it flourish–someone with the skills, knowledge, and time to operate it successfully. Their financial means aren’t everything. If you believe a buyer is an excellent fit for your business, tell them.

3. Do You Have Good Staff?

Buyers know that the people who work at a business are the backbone of it. They’ll pay special attention to the caliber of your staff and the culture of the work environment. Is your staff skilled, experienced, and reliable? Are any of your employees under contract for a set period? Contracts offer stability and continuity post-business sale. Don’t hesitate to brag about your excellent staff and what makes them unique and invaluable to an HVAC business.

4. Is Your Business Profitable?

A potential buyer will, of course, ask if your business is profitable. They will want to see your financials, including revenue, profit, cash flow, and loss statements. They’ll also want a positive multi-year trend of increasing revenue and a forecast for continued revenue growth. Proving your business has steady growth with documentation will show an appealing first glance into the business.

5. Is Your HVAC Business Priced Right?

A wise buyer will want to see detailed proof to validate the listing price of your business. How does it compare to other HVAC businesses for sale in the area that are roughly the same size? Show the comps to back up your price point.

6. Do You Have an Established Customer Base?

Prospective buyers want to ensure a customer base that will stick around after the sale. Someone buying an operating HVAC business wants an established customer base. If they wanted to start from scratch, they’d start their own HVAC business. A solid customer base demonstrates that the company is well-established in the HVAC market with a community of loyal customers.

7. Can I Use Financing?

It’s rare for a buyer to offer an all-cash deal. Buyers typically put forth a significant down payment and finance the rest. However, acquiring financing from lenders can be a challenging process. This leaves the seller (you) with two options:

- Lower your asking price.

- Work out a deal with the buyer to help them overcome the financial hurdles.

Seller financing is gaining popularity in the HVAC business world because it increases the pool of buyers and gives buyers a chance to get a better price.

8. Are There Any Complications?

Buying an HVAC company is a big undertaking. A potential buyer will want to know about any skeletons in the closet. You may as well lay it all on the table now because they will eventually discover it during due diligence. Always be upfront and honest. The information they’re curious about entails legal liabilities, sketchy financial history, labor relations issues, a history of poor work culture or lousy customer service, or anything else that would affect the sale of the business. You’ll lose credibility if you hide them now and they surface later.

9. How Much Does the Business Depend on You?

A business that operates like a well-oiled machine is not overly dependent on one person. If the business depends a lot on you, the transition may require you to stay involved beyond the sale so you can transfer the business properly.

Delegation and efficient processes are necessary components of running a well-operated business. If you plan to sell your business in the future, track when others generate leads and win new accounts. Step back from the day-to-day leadership tasks to prepare your business to run smoothly without you.

10. What do You do to Generate New Business?

If you’ve put some work into your business to make it sale-ready, you should be able to show potential buyers your tried and true process for keeping your pipeline full. Track and document your processes and strategies and the results achieved from your marketing efforts.

11. Do Our Cultures and Values Match?

Potential buyers will want a sense of your business values and culture. A positive company culture helps a business operate well, which, in turn, generates a profit. What is your customer turnover like? If it’s lower than the industry average, that is a good selling point to buyers. Do you take employee surveys? If so, what do they reveal? What are the vibes in your shop? What is the energy flow? How do customers feel when they walk in?

Potential buyers will ask questions to discover whether or not your HVAC business has a strong foundation and a sustainable business model. If you demand top dollar, buyers will want you to demonstrate reasons that back up the price and show you have top-notch value propositions. Be prepared to answer these questions for a smooth and lucrative exit payday.

Video

Infographic

Selling an HVAC business can be complex. Preparation is key. Anticipate buyer questions and be ready with answers. Discover the eleven questions to prepare for when selling your HVAC business in this infographic.