Running a successful business is hard work. You’ve put your heart and soul into it for many years. But now it’s time for a new chapter. Plus, your debt will finally disappear when the business is sold, right? Only sometimes! Many entrepreneurs believe this to be true, that their debt will disappear into the abyss, never having to face it again. In some cases, the existing debt is absorbed or assumed by the buyer, but not in typical cases.

Knowledge is power, and knowing what will happen to your debt when transferring ownership is crucial in exit planning. As lovely as it sounds, you don’t get to ignore the debt and throw a goodbye party.

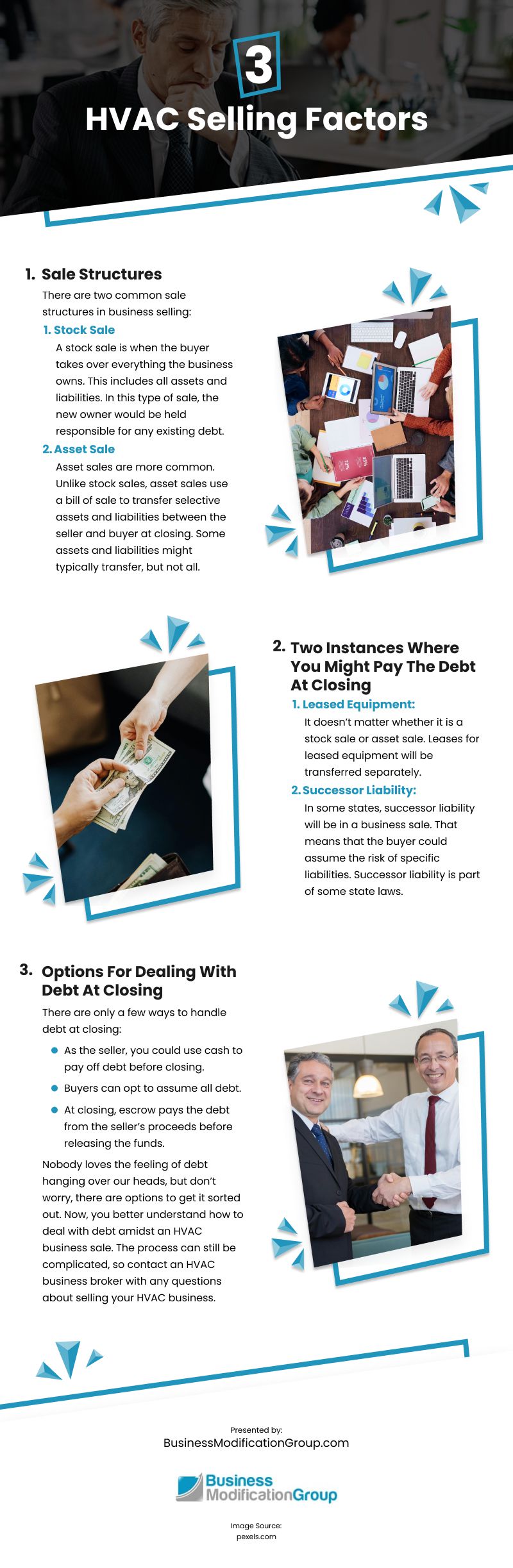

Sale Structures

There are two common sale structures in business selling:

1. Stock Sale

A stock sale is when the buyer takes over everything the business owns. This includes all assets and liabilities. In this type of sale, the new owner would be held responsible for any existing debt. Stock sales are typically only used for huge transactions because of the daunting and expensive task of investigating risks associated with the business’s liabilities. Most small business buyers don’t have the time or money to dig into that level of forensic due diligence.

However, no two business transactions are the same, and there are several exceptions a seller will remain responsible and liable for debt after a stock sale:

- The owner personally “owns” the liabilities.

- The buyer has a contingency that the party selling closes all the debt at the sale closing.

- The seller assumes responsibility and agrees to pay all the debt after closing.

Stock sales are pretty simple; you sign over the stock certificates. The rest of the assets transfer automatically unless the seller or individual owns them.

2. Asset Sale

Asset sales are more common. Unlike stock sales, asset sales use a bill of sale to transfer selective assets and liabilities between the seller and buyer at closing. Some assets and liabilities might typically transfer, but not all.

Most small business buyers select which assets and liabilities to take over to avoid costly and unpleasant surprises so they know what they are walking into. Asset sales rely on clear communication and understanding between the buyer and seller about which assets and liabilities to transfer.

There are various combinations, but most transactions are cash-free and debt-free. This means that when the buyer takes over, they will not assume any of the debt on the seller’s balance sheet and will also not assume any of the cash on the seller’s balance sheet. In this agreement, the seller is responsible for paying off all debt with the funds available post-sale.

Other assets often included in the purchase include:

- Inventory

- Working capital

- Accounts receivable

Although more complicated, asset sales are more common for small businesses because the buyer only sometimes knows how much liability there is so that it can be safer.

Two Instances Where You Might Pay The Debt At Closing

- Leased Equipment: It doesn’t matter whether it is a stock sale or asset sale. Leases for leased equipment will be transferred separately.

- Successor Liability: In some states, successor liability will be in a business sale. That means that the buyer could assume the risk of specific liabilities. Successor liability is part of some state laws. It could allow a creditor to seek recovery from liabilities, whether an asset sale or stock sale, even if the buyer didn’t agree to assume responsibility for the assets.Successor liability shows up most in areas of environmental law, product liability, employment law, and certain tax payments. The laws vary nationwide, so be sure to ask a business broker what the rules are in your state.

In addition, you could also face claims from creditors where the bulk state law is still in effect. The business structure doesn’t matter. The buyer or their team must cover this in their due diligence.

In this situation, the buyer should consider using an escrow company in certain states and include warranties and representations in the sale agreement that require the seller to compensate for successor liability. In many small to midsize HVAC acquisitions, the escrow company holds back a portion of the sale price post-closing to protect the buyer against possible losses due to successor liability.

Options For Dealing With Debt At Closing

There are only a few ways to handle debt at closing:

- As the seller, you could use cash to pay off debt before closing.

- Buyers can opt to assume all debt.

- At closing, escrow pays the debt from the seller’s proceeds before releasing the funds.

Nobody loves the feeling of debt hanging over our heads, but don’t worry, there are options to get it sorted out. Now, you better understand how to deal with debt amidst an HVAC business sale. The process can still be complicated, so contact an HVAC business broker with any questions about selling your HVAC business.

Infographic

Running a successful business is hard work. Knowledge is power, and understanding what happens to your debt when transferring ownership is crucial in exit planning. Read on to learn more in this infographic.

Video