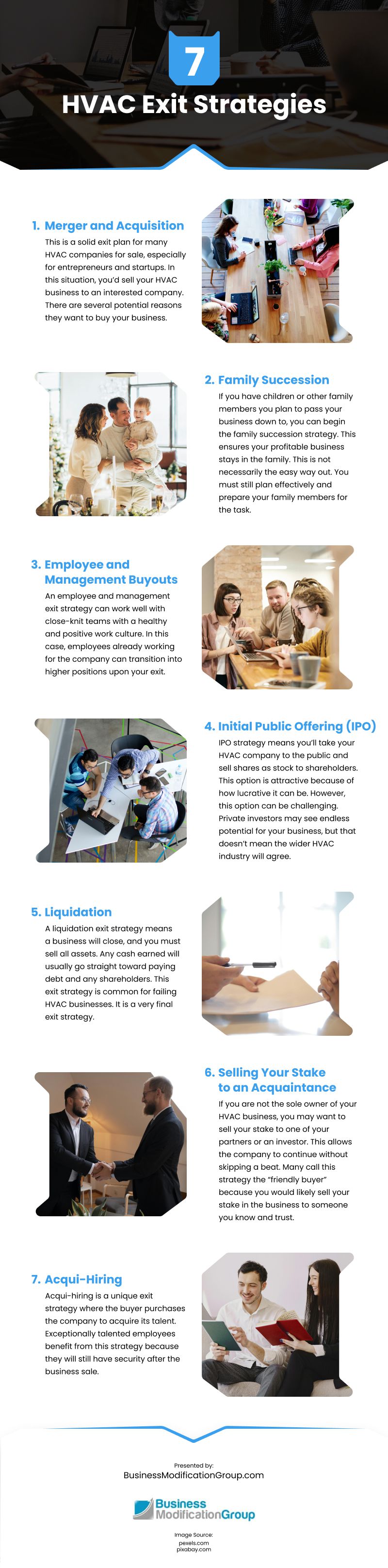

Whether buying an HVAC business was your lifelong dream that you got to live out, and now it’s time to retire, or you’re an entrepreneur who buys and sells businesses all the time, figuring out an exit strategy takes some work. A clear business strategy for exiting your business will prepare you for a smooth and successful transition. Here are several exit strategy options to consider:

Merger and Acquisition

This is a solid exit plan for many HVAC companies for sale, especially for entrepreneurs and startups. In this situation, you’d sell your HVAC business to an interested company. There are several potential reasons they want to buy your business. They may want to eliminate the competition little by little, increase their geographical reach, or invest in your unique talent and business model.

Pros

- This option lets you control the price negotiations and do things on your terms.

- If you’re strategic and sell to a competing business or entertain multiple offers, you can use it in your favor and receive top dollar.

Cons

- Merger and acquisition deals can be expensive and time-consuming.

- They also fail all the time.

Family Succession

If you have children or other family members you plan to pass your business down to, you can begin the family succession strategy. This ensures your profitable business stays in the family. This is not necessarily the easy way out. You must still plan effectively and prepare your family members for the task.

Pros

- Your family member who will acquire the business will likely have had many years to gain valuable knowledge about the company.

- This allows for a gradual transition and enables you to remain closely connected to the company.

Cons

- You may deem your family member incapable or unprepared to take on the owner role.

- Mixing family and business can often put a strain on your relationship.

Employee and Management Buyouts

An employee and management exit strategy can work well with close-knit teams with a healthy and positive work culture. In this case, employees already working for the company can transition into higher positions upon your exit. This is often a smooth transition because these employees have already been intimately invested in your company and have deep business knowledge, making them perfect candidates for upper management positions.

Pros

- You likely know the strengths and weaknesses of your employees and can place them in roles accordingly.

- The transition is usually smooth, straightforward, and exciting.

Cons

- Nobody on your staff may be interested in taking on such a role.

- So many changes at once can negatively impact the business’s daily infrastructure.

Initial Public Offering (IPO)

IPO strategy means you’ll take your HVAC company to the public and sell shares as stock to shareholders. This option is attractive because of how lucrative it can be. However, this option can be challenging. Private investors may see endless potential for your business, but that doesn’t mean the wider HVAC industry will agree. The extreme pressure, costs, and scrutiny from everyone are often why business owners avoid this option.

Pros

- Can acquire an exceptionally high profit

Cons

- Pressure from stockholders, the public, and regulatory bodies.

- IPOs require mandatory performance and progress reports.

- Due diligence in IPO is particularly challenging and costly.

Liquidation

A liquidation exit strategy means a business will close, and you must sell all assets. Any cash earned will usually go straight toward paying debt and any shareholders. This exit strategy is common for failing HVAC businesses. It is a very final exit strategy. This is not always the most exciting option, but in specific circumstances, the best one.

Pros

- If you want to walk away, cut all ties, and never look back, this is that. The company is history afterward.

- This option can be fast and straightforward.

Cons

- Liquidation won’t earn you top dollar. Some see it as the easy way out.

- It’s final; you may have to break ties with many employees, customers, and partners.

Selling Your Stake to an Acquaintance

If you are not the sole owner of your HVAC business, you may want to sell your stake to one of your partners or an investor. This allows the company to continue without skipping a beat. Many call this strategy the “friendly buyer” because you would likely sell your stake in the business to someone you know and trust.

Pros

- The company continues without many disruptions. Revenue continues to stream steadily.

- The person buying your stake is someone you trust and is most likely committed to the business’s success.

Cons

- Finding the right buyer you know and trust for your company share can be challenging.

- This strategy is not always as lucrative. Sellers often feel obligated to lower the price when selling to someone they know.

Acqui-Hiring

Acqui-hiring is a unique exit strategy where the buyer purchases the company to acquire its talent. Exceptionally talented employees benefit from this strategy because they will still have security after the business sale.

Pros

- If a buyer tries to acquire your talent, the ball is in your court regarding negotiations.

- Your employees will have security and certainty for their future at the company.

Cons

- Finding a buyer interested in an acquisition can be challenging.

- This strategy can be a costly, lengthy, and challenging process.

If you’re selling your HVAC business, there are many options and factors to consider before deciding on your approach. Whether you need help with your business valuation and consultation, help choosing an exit strategy, help with a commercial business sales process, or have a small HVAC business for sale, hiring an HVAC business broker can make all the difference. Contact us for expert advice if you need help figuring out where to start.

Video

Infographic

Whether you’ve always dreamed of owning an HVAC business and are planning to retire, or you’re a seasoned entrepreneur who frequently buys and sells businesses, figuring out an exit strategy takes some work. Learn in this infographic about several exit strategy options to consider.