Buying an HVAC business can be a great investment, but only if you know what to look for. Here are 7 Tips on buying an HVAC business.

The recent health crisis has created some opportunities that may not be so obvious. It’s clear that home services, and in particular the HVAC industry, have done very well. With people spending more time at home and working remotely, it has exponentially increased the demand for residential HVAC services. The winners are current and soon-to-be HVAC business owners and we’ve got tips on buying an HVAC business.

“I really haven’t seen the market like this before, it’s astounding.” Those are the comments of well-known business broker, Patrick Lange. “If a good HVAC business is listed, it gets significant interest.” Lange can’t guarantee how long it takes to find a willing seller and buyer because every business and market is different. However, he is clear that there are far more buyers than sellers.

He cautions his buyer clients to look for HVAC businesses that meet certain criteria. Here’s what to look for.

Limited construction exposure

Every healthy HVAC business sells new units, but the profits should only be a percentage of the overall revenue pie. He shares that only installing new units as in the case of new community construction, can be dangerous. When the project nears completion or a relationship with a builder sours, it can be a death blow if no other income stream exists. The exception is if customers were sold a maintenance agreement that continues in perpetuity.

The recurring revenue stream makes planning for equipment upgrades, hiring, and inventory levels much more predictable.

Customer concentration

Everyone wants the big customer, but when just one or two customers represent the majority of revenue, it’s a dangerous place to be. In the HVAC space, it can happen if there is a commercial customer with multiple sites or an active homebuilder in the area. Even though the existing HVAC business owner will ensure that the relationship is on solid footing, dozens of things can happen that can cause that business to dry up overnight. And will the customer want to do business with a new owner he doesn’t know?

Employees

Building a great HVAC business is not unlike other businesses, If you treat customers well and deliver a great service for a fair price, you’ll grow. But in the HVAC world, the limiting factor is almost always the trained technicians…or lack of them. Lange shares that he has repeat clients that buy HVAC businesses not only for their customer list, but for the employees. It’s as much of a recruiting strategy as a business development move. Look for dedicated, competent employees that have a good attitude and love the trade.

Economies of scale

This applies more to existing HVAC owners looking to expand their business. When evaluating another business, look for ways you might be able to streamline costs by combining the businesses. For example, you might be able to negotiate better workers comp and insurance rates if you had more employees. The overall cost to the blended organizations could be less for both. Make sure to work with your business broker to think these through. It will help you make a better decision if you understand what expansion will do to your costs.

Look for clean books

“This is a biggie,” Lange says. “The financial records are really the only historical information we have to go by when evaluating a buying opportunity. If the owner has not been diligent with keeping good records, it doesn’t give the buyer confidence to move forward.” Remember what President Ronald Regan said: “Trust, but verify?” That’s exactly how motivated buyers should operate. If the seller has a problem proving past performance, it’s a red flag. Also true is polluting books with inappropriate personal benefits and expenses. Enlist the help of a broker to make sense of what are likely hundreds if not thousands of transactions.

Getting it financed

Most small business transactions go through one of the few SBA loan programs offered by the federal government. What some people may not know, is that the bank not only qualifies the buyer, but they also have to qualify the selling business. They want to be sure the business can cash flow and service the loan debt plus a reasonable salary for the new owner. If the bank can’t make the numbers work, a financed deal won’t go forward. In fact, Lange always gets businesses pre-approved by the bank even before they officially go on the market, something all brokers don’t do. “I’ve learned over years that if the bank doesn’t approve the business, it will likely kill the deal. I don’t want everyone to get their hopes up only to learn this in the 11th hour.”

Systems

Any business that stands the test of time has to have systems in place to track critical functions like accounts receivable, customer contact information, scheduling, billable hours, and a dozen other details. However, how this is tracked can vary greatly. Look for businesses that have evolved from a three-ring binder to modern electronic tracking. Even if the business systems have room for improvement, prudent buyers should have some level of trust that what is being represented is actually true. Sometimes an organized new owner can turn a good business into a great one simply by implementing better systems and avoiding waste. Two great purpose-built software tools Lange likes are ServiceTitan and Housecall Pro.

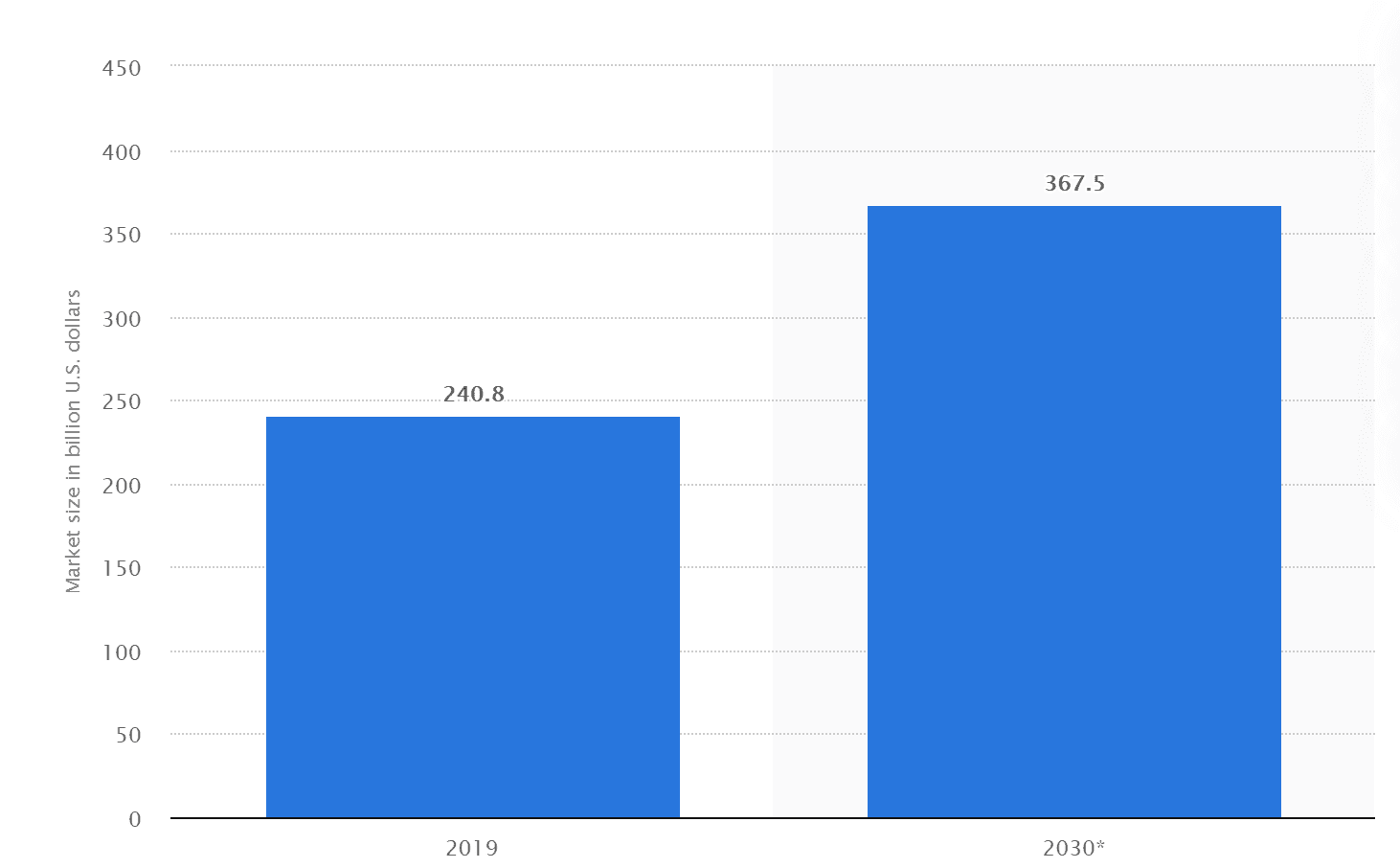

Projected Market Size for Heating, Ventilation and Air Conditioning Worldwide from 2019 to 2030

*Source:

The fact remains that getting into the Heating and Air service industry is a wonderful career move. Unlike other business fads that come and go, the HVAC business has proven to be resilient and not susceptible to disruptive technology. Lange concludes “I think what buyers like most about the HVAC business is the predictability and resistance to economic fluctuations. A steady 3.9% to 6% year over year projected industry growth sounds great to a lot of entrepreneurs.”

Patrick Lange is an experienced HVAC specific business broker with Business Modification Group based in Horseshoe Beach, Florida. He has a unique background in financial planning and has even owned an HVAC business himself. This makes him well suited to working with some of the most successful HVAC business owners in the country. Specializing in companies with 1-10 million dollars in revenue, he maintains a network of buyers and sellers in the industry. He has sold more HVAC businesses than any other broker in the United States over the last 12 months and is currently the Vice President of the Business Brokers of Florida (North Florida District.)

Leave A Comment

You must be logged in to post a comment.